User Manual of Our Loan calculator:

If you see any mistake in your typing of loan amount or percent of interest or anything, or you need to clear the calculator, click Clear Button.

- Input all your gathering info correctly and press Calc Button to calculate.

- To clear all fields, click clear button.

- If you want to keep your calculation, click Print Button,

- If you need any assistance you can click Help Button.

- To see the Payment Schedule, click on Payment Schedule Button.

- To see the graph, click charts Button.

If you are facing any problems, Discuses in our Banks Info Community for help

How does a loan calculator work?

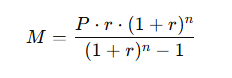

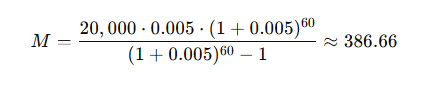

A loan calculator works by taking input data such as loan amount, interest rate, and term length to compute monthly payments and total costs. It uses mathematical formulas to provide estimates based on the entered parameters.

In a word, A loan calculator uses mathematical formulas to estimate key loan details such as monthly payments, total interest, and overall loan cost. By inputting values like loan amount, interest rate, and loan term, the calculator computes results using standard amortization formulas.

What information do I need to use a loan calculator?

You’ll need:

- Loan Amount: The total amount you plan to borrow.

- Interest Rate (APR): The annual percentage rate for the loan.

- Loan Term: The length of time you’ll take to repay the loan (e.g., 36 months, 5 years).

- Down Payment (if applicable): Any upfront payment reducing the loan balance.

- Additional Fees (optional): Extra costs such as origination fees or taxes.

Can a loan calculator provide accurate estimates for different types of loans?

Yes, a loan calculator can provide accurate estimates for various types of loans including personal loans, mortgages, and auto loans by adjusting calculations based on specific terms related to each type.

Yes, a loan calculator can estimate payments for various loans, including:

- Auto loans.

- Mortgages.

- Personal loans.

- Student loans. However, specific features like adjustable rates or balloon payments may require specialized calculators.

Are there any limitations to using a loan calculator?

No, You can use our calculator as much as you can.

How can a loan calculator help me decide on the best loan option for my needs?

A loan calculator allows you to compare different scenarios by adjusting variables like amounts and rates. This helps identify which option fits your budget and financial goals best.

A loan calculator helps by:

- Comparing monthly payments for different loan terms and amounts.

- Showing the impact of varying interest rates.

- Highlighting the total cost of each loan option, including interest paid.

Do loan calculators take into account factors like interest rates and loan terms?

Yes, most loan calculators incorporate interest rates and loan terms as key inputs in their calculations to determine monthly payments and overall cost.

Yes, it provides:

- Total loan cost, including principal and interest.

- A breakdown of how much you’ll pay in interest over the loan term.

Can a loan calculator help me understand the total cost of a loan?

Absolutely. A good loan calculator will show not only monthly payments but also the total repayment amount over the life of the loan including principal and interest.

Are loan calculators reliable for predicting monthly payments?

Yes, they are highly reliable for fixed-rate loans, as long as the input data is accurate. For adjustable-rate loans, the estimates may not account for future rate changes.

Is it possible to compare multiple loan offers using a loan calculator?

Yes, you can input details for each loan offer and compare:

- Monthly payments.

- Total interest paid.

- Overall cost of the loan.

Are there any specific tips for using a loan calculator effectively?

- Double-check all inputs for accuracy.

- Experiment with different loan terms and interest rates to see their impact.

- Use calculators designed for specific loans (e.g., mortgage calculators for home loans).

- Factor in additional costs like fees and taxes if applicable.

- Consider prepayment options to see potential savings.

Let me know if you need help with specific calculations!